The annual changes to customs tariff numbers are particularly extensive this year. If your goods are affected, the customs tariff number must be updated accordingly

Each year, changes are made to customs tariff numbers for a wide variety of reasons. On the one hand, the World Customs Organization (WCO) and the World Trade Organization (WTO) together make amendments based on innovations on an international level; on the other hand, changes may be necessary to reflect new developments in trade policy or technical and statistical requirements. In some cases, completely new product groups must also be taken into account; for example, a corresponding classification for 3D printers and their components has naturally only existed for a few years.

Purpose of the customs tariff number

The customs tariff number is a description and coding system aimed at providing a distinct classification of goods on the basis of their nature, function and intended use. It is used to determine the corresponding import and export duties during customs clearance. Possible preferential regulations and rules of origin are also based on the customs tariff number. In addition, customs tariff numbers are used for statistical evaluations of trade flows (export share in a particular commodity group, etc.).

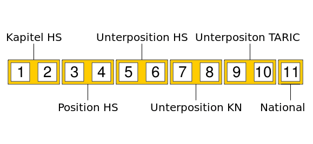

Structure of the 11-digit customs tariff number

The first six digits of the customs tariff number are valid in all member states of the World Trade Organization (WTO). The Harmonized System (HS) developed by the WTO is the basis for coding goods in international trade and is revised every five years by the World Customs Organization (WCO). There are currently 155 contracting parties to this convention, but it is applied by more than 200 customs administrations worldwide.

The six digits of the Harmonized System are broken down as follows:

The first two digits represent a chapter, the following 2 digits describe the so-called heading, the next 2 digits indicate the “subheading” of the HS.

The digits seven and eight of the customs tariff code indicate the Combined Nomenclature (CN) subheading stipulated by the European Union. The combined nomenclature serves the EU’s common customs tariff and provides statistics for trade within the EU and between the EU and the rest of the world. It is important to note that the CN code is updated annually.

Digits nine and ten (known as TARIC = Integrated Tariff of the European Communities) encode Community measures such as antidumping rules, duty suspensions or tariff quotas and are only required for import.

The eleventh digit of the code number is for national use only, and is, for example, used to encode VAT rates or national bans or restrictions.

The first six digits are by and large the same all over the world. The subsequent digits may differ, which can lead to discussions between seller and buyer about which number to use.

The following table illustrates the structure of the customs tariff number using two examples (salt, coats):

| Formal structure | Codenumber | Goods | Codenumber | Goods |

| HS Chapter first two digits | 25 | SALT; SULPHUR; EARTHS AND STONE; PLASTERING MATERIALS, LIME AND CEMENT | 62 | ARTICLES OF APPAREL AND CLOTHING ACCESSORIES, NOT KNITTED OR CROCHETED |

| HS Heading second two digits | 2501 | Salt (including table salt and denatured salt) and pure sodium chloride, whether or not in aqueous solution or containing added anti-caking or free-flowing agents; sea water: | 6202 | Women’s or girls’ overcoats, car coats, capes, cloaks, anoraks (including ski jackets), windcheaters, wind-jackets and similar articles, other than those of heading 6204: |

| HS – Subheading third two digits | 2501 00 | 6202 11 | — Of wool or fine animal hairn | |

| CN subheading 7,8 digit | 2501 00 51 | – – – Denatured or for industrial uses (including refining) other than the preservation or preparation of foodstuffs for human or animal consumption | ||

| Subheading – TARIC / Common characteristics 9,10 digit | 2501 00 51 10 | – – – – Denatured | 6202 1100 20 | – – – Hand-made capes of wool |

| National Code Numbers /used for national purposes eg prohibitions and restrictions, encryption of import turnover tax rates, digit 11 and following |

How do I determine if my goods need reclassifying?

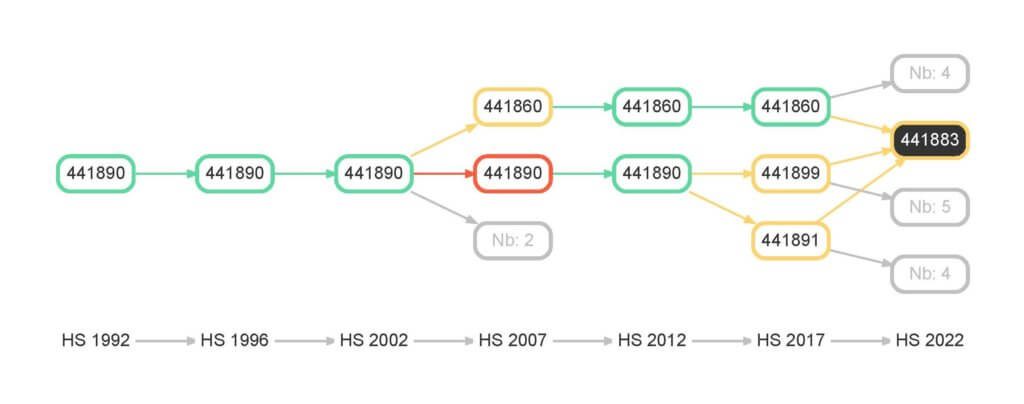

Correlation tables are provided for the reallocation of tariff numbers.

The WTO has published an online tool to compare HS editions of different years. With this tool, all versions of the Harmonized System can be compared with each other as required:

Attention: The tools presented here are NOT legally binding.

Salzburg, 13.12.2021

Deutsch

Deutsch  English

English  Русский

Русский