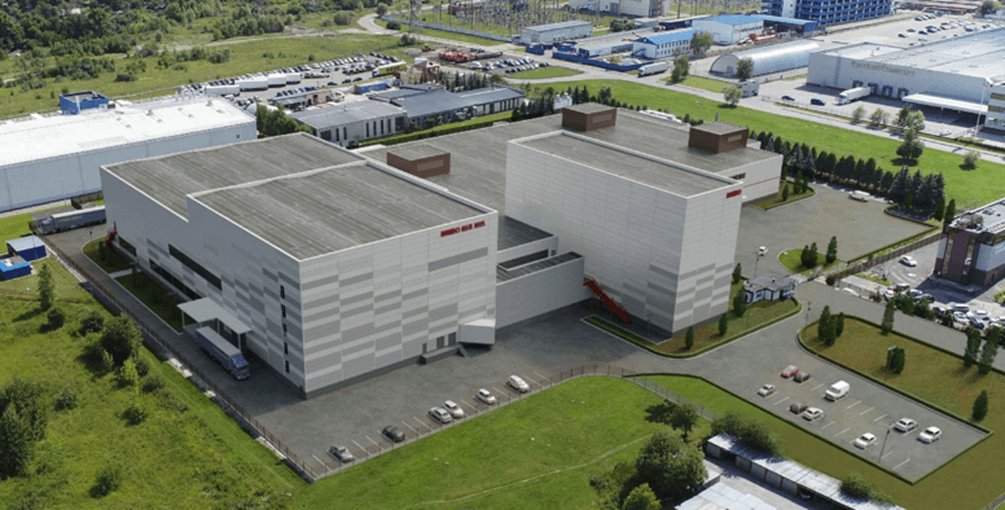

How to get an entire bakery to Russia

Grupo bimbo’s bakery in Russia is built using factory components supplied from all over the world: A logistical challenge of the highest order.

Project duration of over 1 year; more than 100 trucks and containers from all over Europe and America; innumerable certifications, permits and classification notices; interim storage in several locations and escorted special transports … these are just a few of the stats that went into this mammoth project, carried out for the world’s largest baked goods company, Grupo Bimbo.

The mission itself was just as mammoth in its scope: Huge silos, entire production plants, cranes and the like were to be dispatched, transported, cleared through customs, placed in interim storage and then delivered. But if the transport alone sounds challenging, it was nothing compared to the advanced planning and handling the formal procedures required!

For example, to keep the customs rates low, the manufacturing plant needed to be either imported in its entirety or in individual subunits instead of singular components. However, if an individual subunit was to be cleared through customs, it had to actually arrive at customs in its entirety and all at the same time, even if parts of it were possibly divided among ten trucks coming from different countries.

Facts like this show how crucial planning and preparation are to successfully handling a complex project of this magnitude!

Read on to find out what you need to consider and which basic questions need to be clarified in order to carry out a large-scale project such as this:

Individual parts vs. block clearance: Customs clearance planning is key!

If an entire facility or its subunits can be declared as complete entities, the import duties are much lower than the customs clearance of individual parts! Why? Since a single screw can easily be produced domestically, it is taxed relatively high in order to promote domestic sales. The import of a whole plant, on the other hand, is taxed less because it then serves production and, thus, creates value in the importing country.

Furthermore, importing individual parts also means that the individual components of a system, from switches to cables, have to be certified, tariffed and cleared through customs at greater expense. On the other hand, there is no need for complex coordination with the delivery of other plant components. In contrast, block clearance of factories/subunits means that customs can be paid more cheaply. But while a whole or partial facility can be certified and imported using less effort, the planning and organization in advance is enormous by comparison, because one of the conditions for block clearance is that the unit be certified in its entirety and presented to customs together all at once (for exception see “classification decision”). In the worst case, that would mean that nothing moves even if just one out of 20 trucks arrives late. The flexibility that comes with declaring individual components is gone, because once a factory or subunit is certified as a complete entity for customs clearance, no more changes can be made.

The bottom line is that a compromise must always be made between high costs and flexibility on the one hand, versus a great deal of planning effort, no possibility for changes, but lower costs on the other.

“Classification decision”:

By having an entire bakery, or a part of it, classified as a unit in advance by Russian customs, you buy yourself time. Using a classification certificate, not all components from the entire (or partial) factory that need to be cleared through customs must be submitted to customs at the same time. But filing for the certificate with Russian authorities is a very complex procedure.

Learn more …

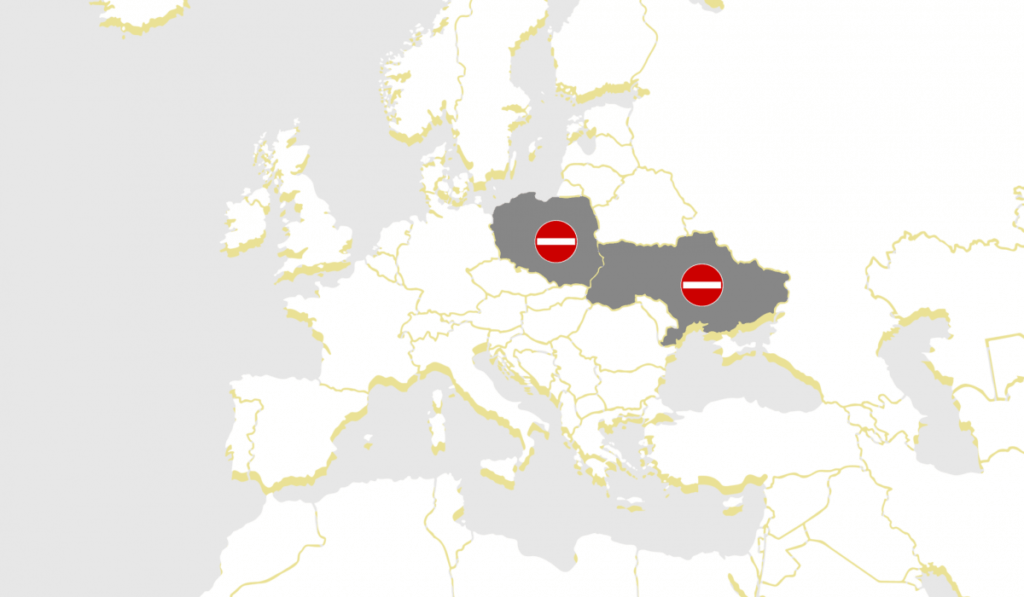

The difficult road from border to inland customs office:

As a rule, import customs clearance does not take place at the external border of a customs territory, but at the inland customs office, which is usually located near the importer. From the border, the goods must be brought to the inland customs office under customs supervision by way of shipping or transit. Both of these methods for the transfer of entire facilities require extremely meticulous planning for transit across the customs territory of the Eurasian Economic Union, usually from the Belarusian or Russian border to the customs office of the final destination. For the route from the border to the inland customs office, there must be security for import duties, in case goods do come into circulation prematurely. And this for all the individual components, since the plant formally only merges into one unit at the inland customs office! This results in the paradoxical situation that, despite an overall customs clearance, all the detailed manufacturer information must be provided, as if all the parts had to be cleared through customs individually. Organizationally speaking, this circumstance often results in the most complex problems.

The subsequent delivery of parts dilemma:

Chances are that some shipped components will break during assembly, or that they get misplaced or lost. It can even be that you are short a few meters of cable for completing the assignment. The project comes to a screeching halt and your Russian buyer usually cannot help because he has already officially imported all the parts. Learn more …

Certification:

Each individual part, each bakery subunit or even the entire manufacturing plant must be certified according to Russian standards in order to prove that the product has the desired characteristics and the desired quality for the Russian market. Well-known certifications by TÜV, CE or organizations with similar standards are of limited help. Learn more …

Carnet ATA:

Tools, measuring instruments and special devices are often imported for a limited period of time for assembly and installation, and then sent out of the country again after completion. In the event that this does not happen, and the equipment is instead put into circulation, the importing country requires security for the duties incurred. Whenever goods are to be imported into a country without import duties for temporary use only, the ATA Carnet is the customs document of choice. Learn more …

English

English  Français

Français  Русский

Русский